King County 2024 Property Tax. To review current amounts due or pay your property tax bill, please use our safe and secure online ecommerce system. I do not know my parcel/account number.

If you’re a king county homeowner, it’s likely your home’s assessed value fell in 2024. The total taxable property value in your community;

You Will Need To Fill Out A Separate Application For Each Year.

The final amount depends on the cost of state and local government.

To Find Your Tax Account Or Parcel Number.

To review current amounts due or pay your property tax bill, please use our safe and secure online ecommerce system.

Find Out How To Report Your Property.

Images References :

Source: zarlaqfanechka.pages.dev

Source: zarlaqfanechka.pages.dev

King County Property Tax Increase 2024 Bill Marjie, The motion requests that the executive’s proposal include a proposed property tax levy lid lift for voters to decide on in november 2024, as well as policy recommendations for how the money could be allocated among projects in areas including transportation, open space acquisition and response to climate impacts. Download and view pdfs of the assessor’s statistical reports for 2024.

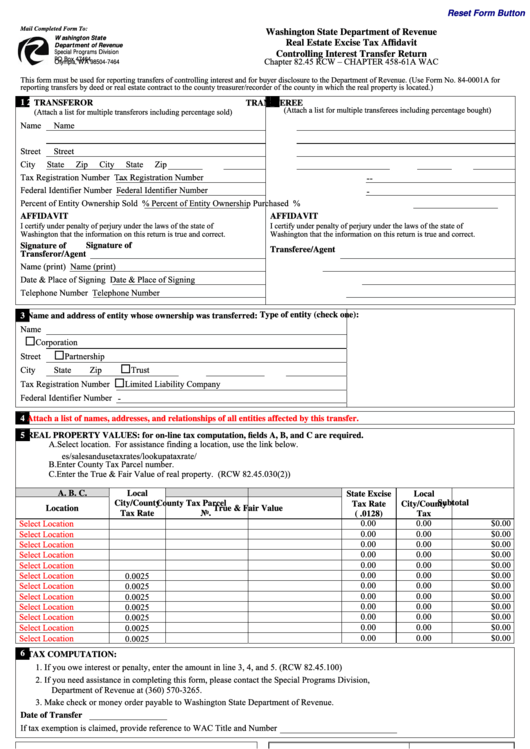

Source: www.printableaffidavitform.com

Source: www.printableaffidavitform.com

King County Real Estate Excise Tax Affidavit Form 2024, At the april 22 board of supervisors meeting, they criticized a decision made last september to lower the personal property rate on. Budgets adopted by your local governments;

Source: kingcounty.gov

Source: kingcounty.gov

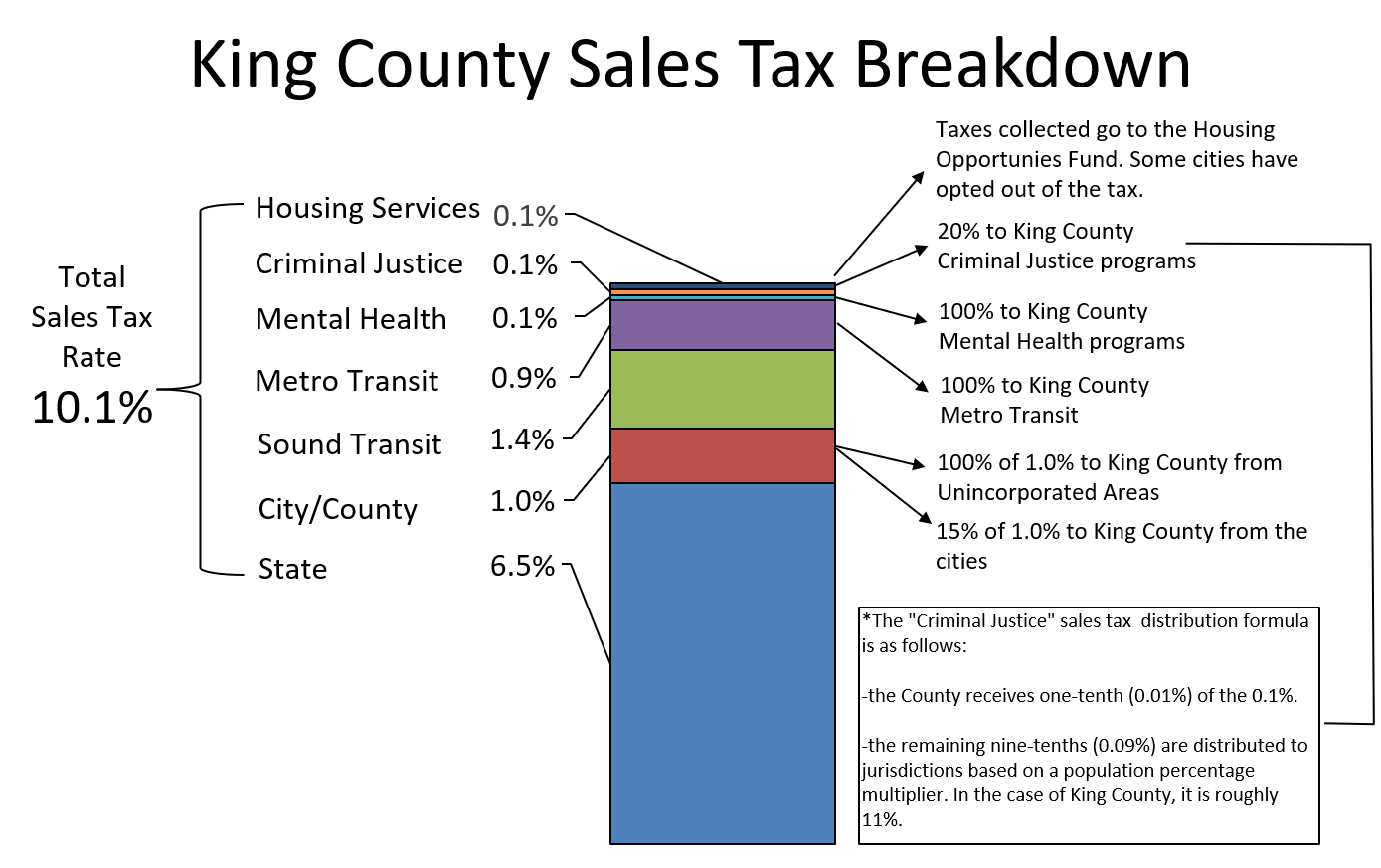

King County Sales Tax King County, Phone numbers are shown at bottom of this page. Then, we calculate your tax based on the following:

Source: woproferty.blogspot.com

Source: woproferty.blogspot.com

How Much Is Property Tax In King County WOPROFERTY, The last regular county council meeting to pass the ordinance with minimum processing time would be july 23, 2024. You will need to fill out a separate application for each year.

Source: www.pinterest.ca

Source: www.pinterest.ca

The table shows the tax brackets that affect seniors, once you include these clawbacks. Seniors, Receive your property valuation notice electronically via email. At the april 22 board of supervisors meeting, they criticized a decision made last september to lower the personal property rate on.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, That’s higher than the state of washington’s overall average effective property tax rate of 0.84%. For example, in february of 2023, you received a tax bill for the value of your property as calculated on january 1, 2022.

Source: my-unit-property-9.netlify.app

Source: my-unit-property-9.netlify.app

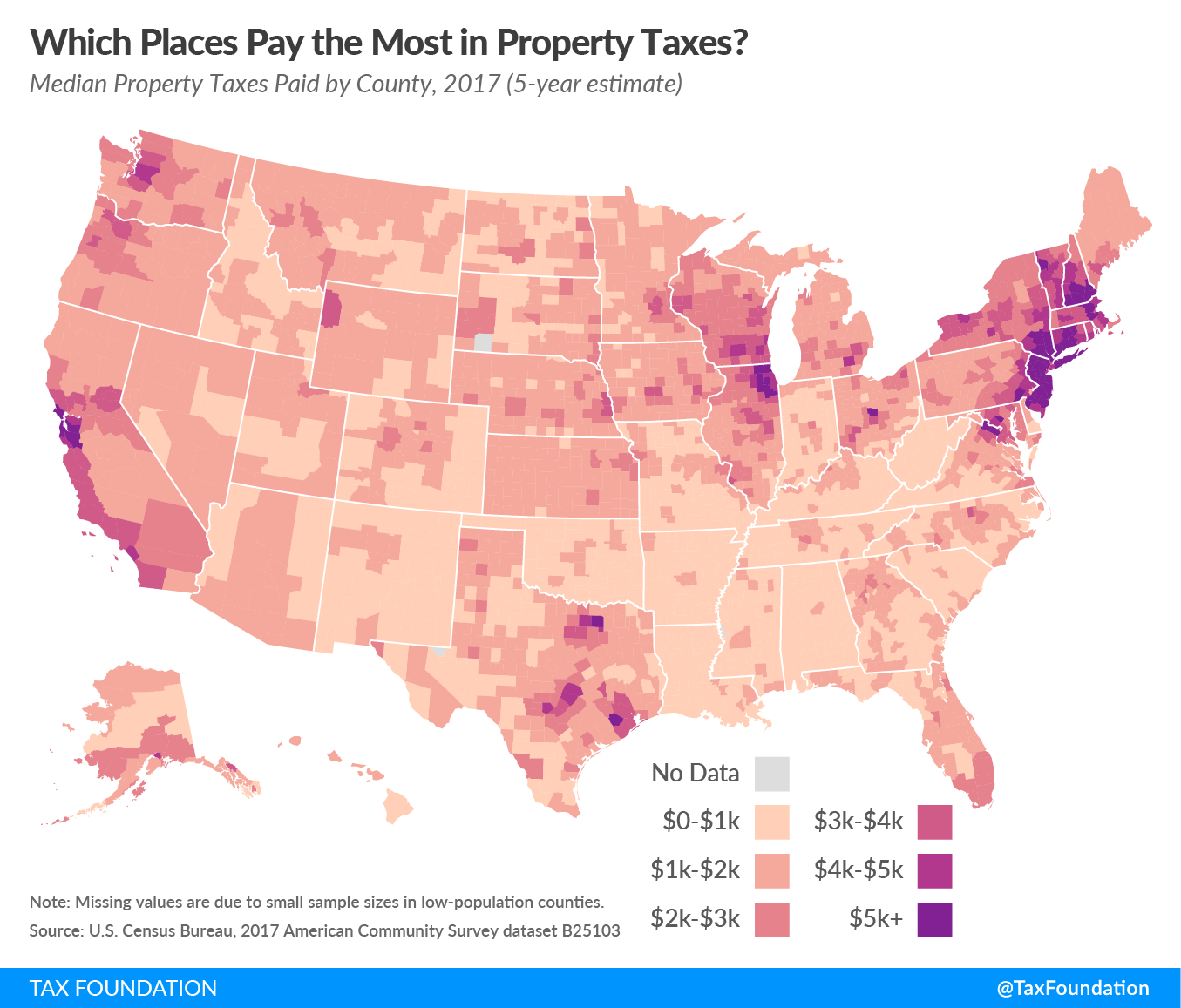

Real Estate Property Tax By State, We base the property taxes you pay this year on the value of your property as of january 1 the previous year. King county collects, on average, 0.88% of a property's assessed fair market value as property tax.

Source: taxfoundation.org

Source: taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation, The king county assessor’s initial report suggests places like queen anne could see an 8% reduction,. King county, washington’s average effective property tax rate is 1.05%.

Source: propertytaxgov.com

Source: propertytaxgov.com

Property Tax King 2022, The median property tax in king county, washington is $3,572 per year for a home worth the median value of $407,700. Phone numbers are shown at bottom of this page.

Source: www.atcoastal.com

Source: www.atcoastal.com

How Property Taxes Can Impact Your Mortgage Payment Coastal Virginia Real Estate AtCoastal, The assessed value of your property; Check our frequently asked questions (faq).

You Can Apply For A Property Tax Exemption For 2024, 2023, 2022 And 2021.

1 would restore the district's regular property tax levy rate to $1.50 per $1,000 of assessed value for collection in 2024, and permit annual revenue increases of up to 6% for each of the succeeding five years, with the levy never exceeding the $1.50 per $1,000 rate limit.

Expect Modest Increases This Year Despite Rising Values.

The total taxable property value in your community;