Fincen Boi Filing Requirements 2024. Thanks to the corporate transparency act, starting jan. Washington—the financial crimes enforcement network (fincen) issued.

Companies created in 2024 have 90 days from their creation date to file boi reports, while the deadline for companies created before 2024 is jan. Need to file another type of bsa report?

Fincen Boi Filing Requirements 2024 Images References :

Source: daronbsilvana.pages.dev

Source: daronbsilvana.pages.dev

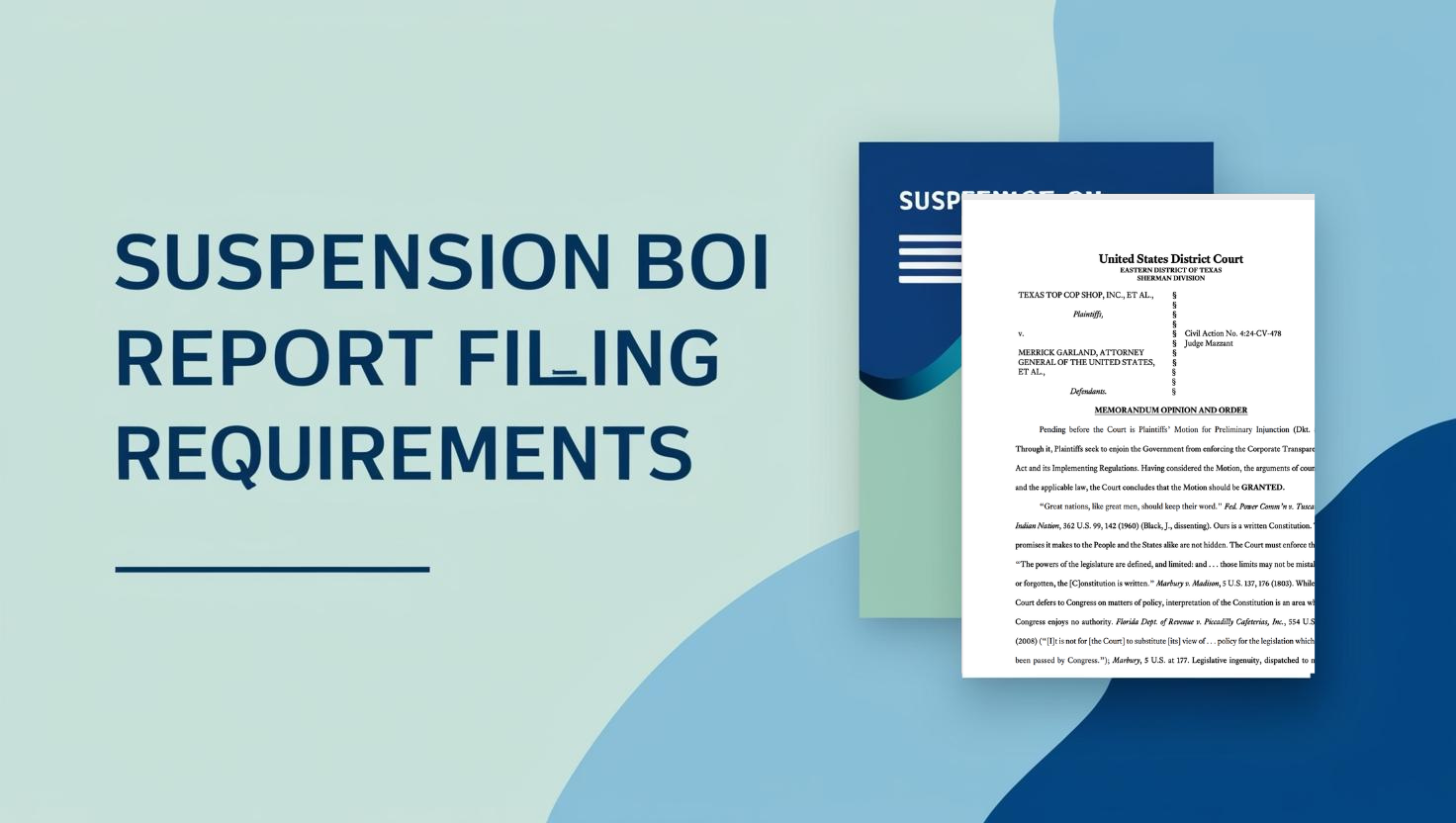

Boi Reporting 2024 Appeal Process Joni Roxane, Boi filing requirement suspended on dec.

Source: www.currentfederaltaxdevelopments.com

Source: www.currentfederaltaxdevelopments.com

FinCEN Announces Opening of Website to Accept Beneficial Ownership, As the end of 2024 approaches, us businesses are navigating the beneficial.

Source: www.kitces.com

Source: www.kitces.com

FinCEN's 2024 New Beneficial Ownership Information (BOI) Reporting, In light of a recent federal court order, reporting companies are not currently required to file beneficial.

Source: cammyygrethel.pages.dev

Source: cammyygrethel.pages.dev

Boi Reporting 2024 Requirements For Banks Fern Desirae, Companies founded or registered on or.

Source: gyf.com

Source: gyf.com

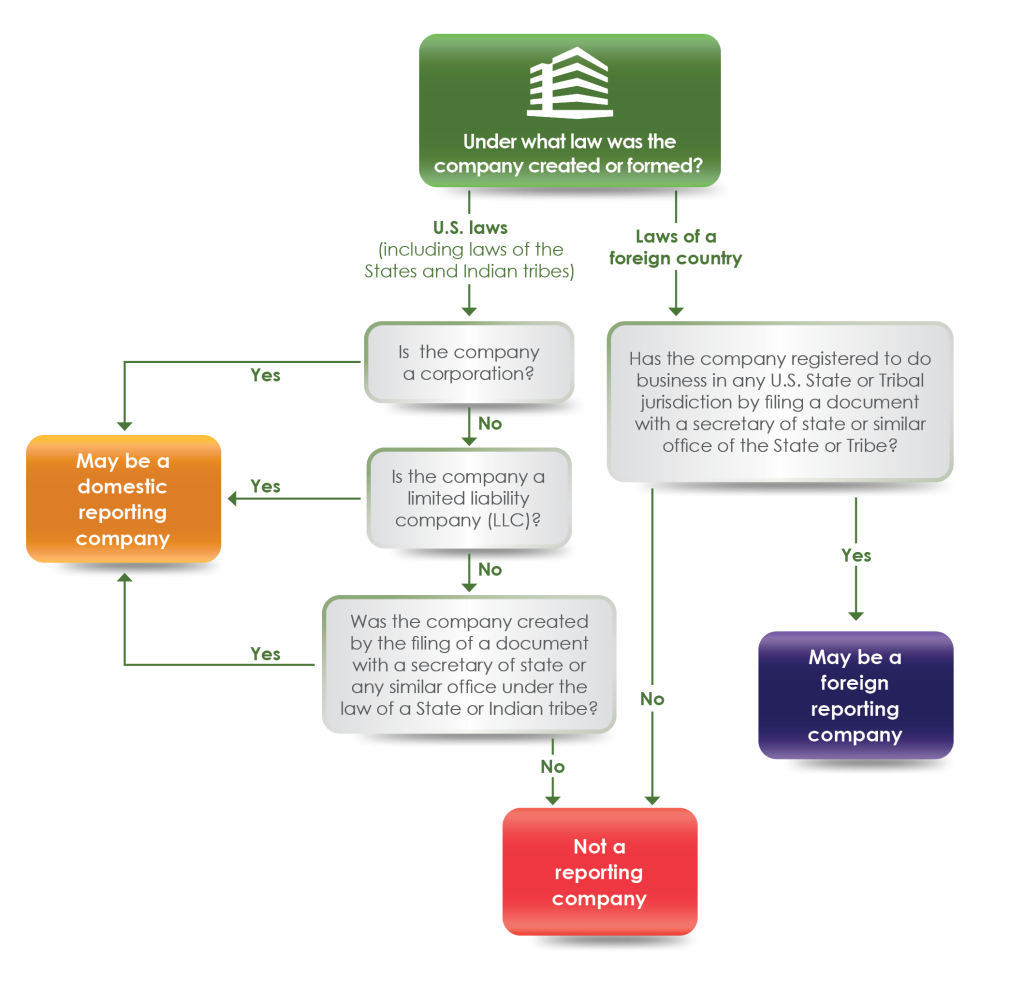

Federal CTA Beneficial Ownership Reporting Requirements GYF, The following materials are now available on fincen’s beneficial ownership.

Source: www.giudicecpa.com

Source: www.giudicecpa.com

Beneficial Ownership Information Reporting Requirements Giudice, CPA, The following materials are now available on fincen’s beneficial ownership.

Source: easyfiling.us

Source: easyfiling.us

Understanding the Temporary Suspension of FinCEN BOI Report Requirements, Boi filing requirement suspended on dec.

Source: brennbkarmen.pages.dev

Source: brennbkarmen.pages.dev

Boi Filing 2024 Fincen Casi Martie, With the new beneficial ownership information (boi) reporting requirements officially underway, 2024 is the year to ensure your business complies.

Source: sharabminerva.pages.dev

Source: sharabminerva.pages.dev

File Boi With Fincen 2024 Misha Susana, Learn about the extended fincen filing deadline for 2024 registrations and start reporting with ease.

Source: activerain.com

Source: activerain.com

13 Answers on the New 2024 CTA Required BOI Reporting t, Fincen began accepting reports on january 1, 2024.

Category: 2024